The CBI ( Cross Border INVESTMENT )

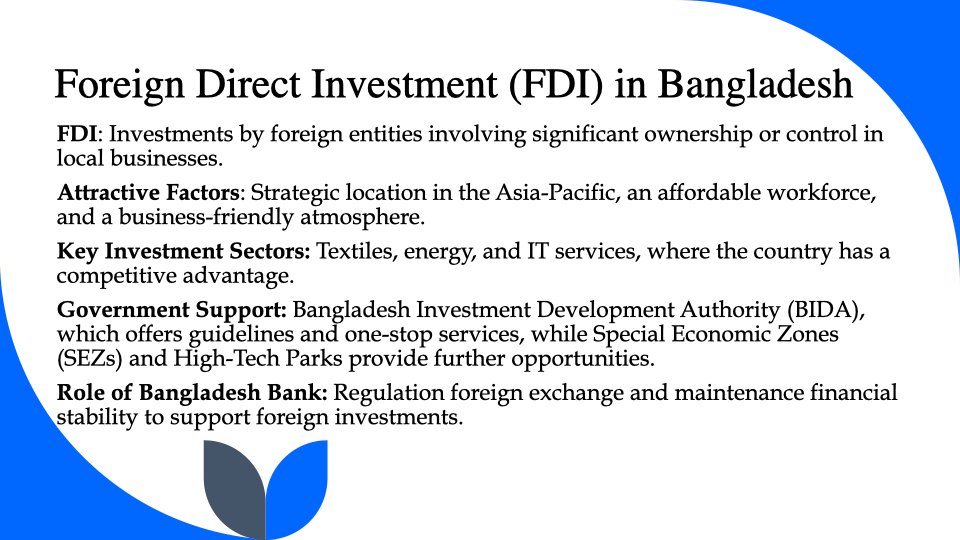

Foreign Direct Investment (FDI) in Bangladesh

Foreign Direct Investment (FDI) refers to investments by individuals or companies in foreign businesses, often involving significant ownership or operations in another country. Bangladesh, with its affordable workforce and strategic location in the Asia-Pacific, offers attractive investment opportunities. The country’s business-friendly environment, competitive advantage in global value chains, and favorable biodiversity make it a strong investment hub. Key sectors for FDI include textiles, energy, and IT services. The government’s focus on Special Economic Zones and high-tech parks further enhances opportunities. FDI in Bangladesh is governed by Bangladesh Investment Development Authority (BIDA), which provides guidelines and one-stop services for investors. Bangladesh Bank facilitates FDI by regulating foreign exchange, ensuring financial stability, and supporting SEZs. Together, they create a favorable environment for foreign investment.

Investment opportunities in Bangladesh

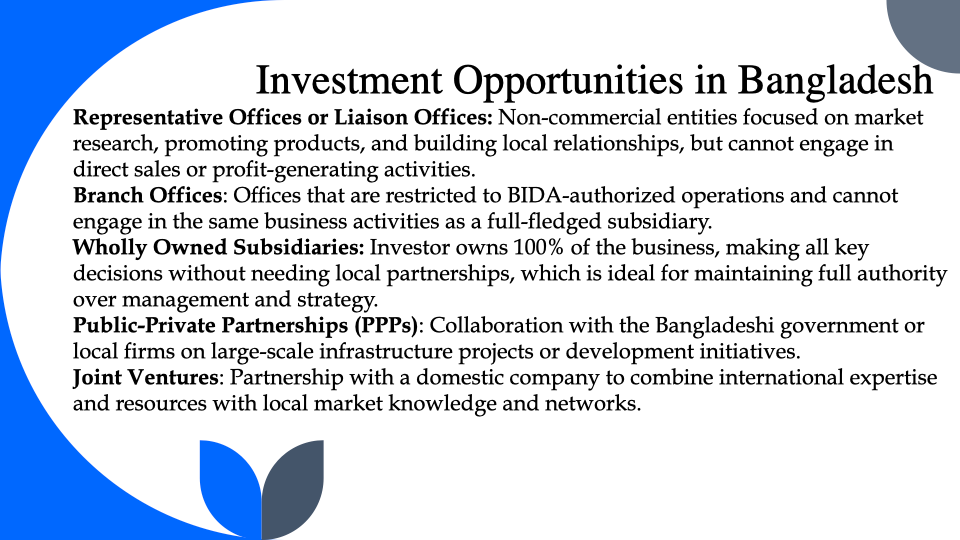

Foreign investors have several investment opportunities to invest in Bangladesh with subject to registration, approval, authorization, and certification from Bangladesh Investment Development Authority (BIDA), Registrar of Joint Stock Companies and Firms (RJSC&F), Bangladesh Bank, National Board of Revenue (NRB) etc. Laws empire manages the approval and authorization paperwork, as well as the registration applications, certification and licenses needed for foreign investment. Investment opportunities that are present in Bangladesh are as follows:

- Representative Offices or Liaison Offices: Foreign investors may establish representative or liaison offices. Representative or liaison offices are non-commercial entities which can’t engage in direct sales or profit-generating activities but are especially designed for activities like market research, promoting products, and building relationships by establishing local connections.

- Branch Offices: Foreign companies can establish branch offices in Bangladesh to conduct business activities like marketing, sales, and customer services. They are not permitted to engage in the same level of business operations as a full-fledged subsidiary. These offices are restricted to BIDA authorized activities.

- Wholly Owned Subsidiaries: Foreign investors have the opportunity to establish wholly owned subsidiaries in Bangladesh, granting them complete control over their operations. This means the investor owns 100% of the business, making all key decisions without needing local partnerships, which is ideal for maintaining full authority over management and strategy.

- Public-Private Partnerships (PPPs): Foreign investors can also engage in Public-Private Partnerships (PPPs), where they collaborate with the Bangladeshi government or local firms on large-scale infrastructure projects or development initiatives. PPPs are often used for projects in sectors like transportation, energy, and healthcare, enabling foreign investors to share risks and resources while contributing to national growth.

- Joint Ventures: Another entry option is forming joint ventures with local businesses. In a joint venture, foreign investors partner with a domestic company to combine international expertise and resources with local market knowledge and networks. This collaboration can help foreign companies navigate the local business environment more effectively, mitigating risks associated with unfamiliar markets.

- Special Economic Zones (SEZs): Bangladesh offers Special Economic Zones (SEZs), which are dedicated areas designed to attract foreign investment by offering tax incentives, reduced tariffs, and access to advanced infrastructure. These zones are ideal for investors seeking to set up manufacturing plants or service-based operations, benefiting from streamlined procedures and cost-effective operations.

- Acquisitions and Mergers: Another way for foreign investors to enter the market is through acquisitions or mergers with established local businesses. By acquiring or merging with a local company, foreign investors can quickly gain access to an existing customer base, local expertise, and established market presence. This approach can be faster and more cost-effective than building a business from the ground up.

- Franchising: Foreign investors can introduce international brands to the Bangladeshi market through franchising. This is particularly common in the retail, food, and service industries, allowing foreign brands to leverage local franchises to expand quickly without managing day-to-day operations themselves. Franchising offers a lower-risk entry model, with proven business models and brand recognition.

- Equity Investment: Foreign investors can buy shares of local companies listed on the stock exchange or invest in private companies by purchasing equity. This allows them to become partial owners of the company and benefit from dividends and capital appreciation.

- Stock Market: Foreign investors can directly invest in publicly listed companies on the Dhaka Stock Exchange (DSE) or Chittagong Stock Exchange (CSE). They can buy shares of companies in various sectors, such as manufacturing, energy, and services.

- Foreign Portfolio Investment (FPI): Foreign investors can also engage in Foreign Portfolio Investment by purchasing shares or other securities of publicly listed companies. This investment is typically in the form of short-term, non-controlling ownership.

These various entry strategies offer foreign investors flexibility in how they engage with Bangladesh’s market, enabling them to choose the approach that best aligns with their business goals, resources, and risk tolerance.

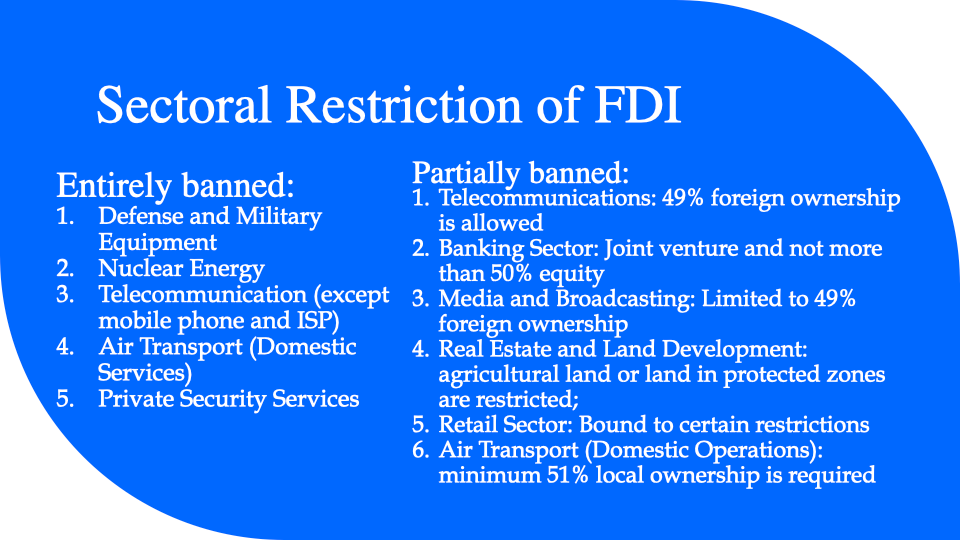

Sectoral Restriction of FDI

In Bangladesh, certain sectors are restricted or prohibited from Foreign Direct Investment (FDI) for various reasons such as national security, cultural preservation, or to protect domestic industries. The sectors where FDI is not allowed at all include:

- Defense and Military Equipment – Foreign investment in defense and military-related sectors is strictly prohibited for reasons of national security.

- Nuclear Energy – Foreign investment in nuclear energy production is restricted due to the sensitive nature of the industry and national security concerns.

- Telecommunication (except mobile phone and ISP) – FDI in the telecommunication infrastructure, such as fixed-line telephone services and related networks, is often restricted or controlled to ensure national control over the communication sector.

- Air Transport (Domestic Services) – While foreign investment is allowed in international air transport services, domestic air transport services have restrictions on foreign ownership.

- Private Security Services – Foreign investment is not permitted in private security services, as these are deemed critical to national safety and security.

These restrictions are designed to safeguard national interests and ensure that sensitive sectors remain under domestic control. However, Bangladesh generally encourages FDI in many other sectors such as manufacturing, infrastructure, energy, and services.

On the other hand, in Bangladesh, certain sectors are partially banned or restricted from Foreign Direct Investment (FDI), meaning foreign investment is allowed under specific conditions or within certain limits. These sectors include:

- Telecommunications (Mobile Phones and Internet Service Providers): While FDI is allowed in the mobile phone and ISP (Internet Service Provider) sectors, there are restrictions on the percentage of foreign ownership. Foreign investors can hold a maximum of 49% ownership in these businesses, subject to approval from the government.

- Banking Sector: Foreign investment is allowed in the banking sector, but it is subject to restrictions. Foreign banks can operate in Bangladesh, but they must have a joint venture with a local partner, and foreign ownership is capped at a certain percentage. For example, foreign banks may not hold more than 50% of the equity in a joint venture bank.

- Media and Broadcasting: Foreign investment is restricted in the media and broadcasting sector. Foreign ownership is limited to 49% in media companies and broadcast operations. However, the media sector remains under strict government regulations.

- Real Estate and Land Development: While foreign investment in real estate is allowed, it is restricted in certain cases, particularly in the development of agricultural land or land in protected zones. There are guidelines governing the extent of foreign involvement in large-scale real estate projects, especially regarding land ownership.

- Retail Sector: Foreign investment in the retail sector is allowed but is often restricted to wholesale operations. Foreign retail companies may need to follow certain conditions, including limitations on the size and nature of stores and must focus on high-end retail or foreign brand outlets.

- Air Transport (Domestic Operations): While foreign investment in international air transport is allowed, foreign investors face restrictions on ownership of domestic air transport operations. Domestic air service providers often need to have a majority of local ownership (minimum 51% local ownership is required).

These partial restrictions are designed to ensure that Bangladesh retains control over sensitive sectors while still encouraging foreign investment where appropriate.

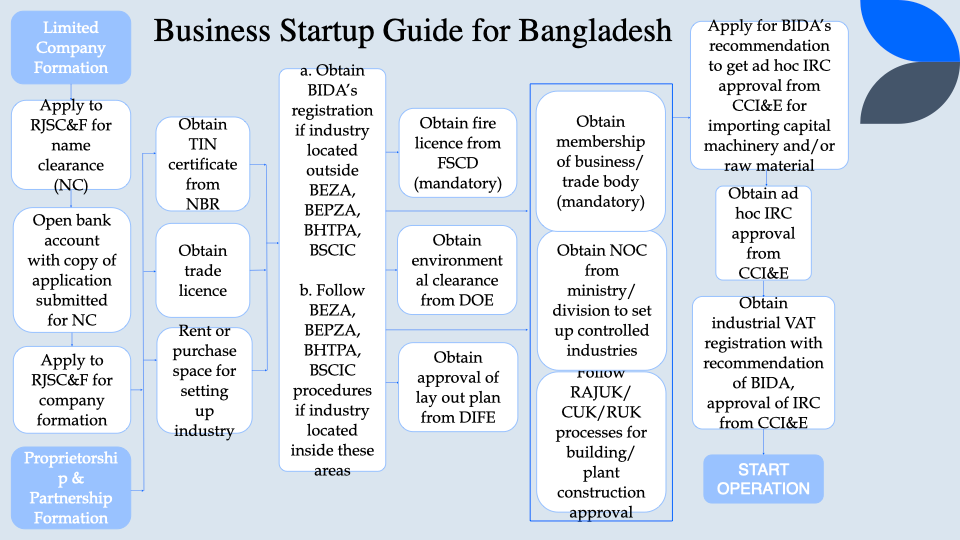

Business Startup Guide for Bangladesh

The roadmap for starting a business involves different steps based on the chosen business type: proprietorship, partnership, or limited company formation. For a limited company, the process begins with applying to the Registrar of Joint Stock Companies and Firms (RJSC&F) for name clearance (NC). Once the name clearance is obtained, the next step is to open a bank account using the NC application and proceed to apply to the RJSC&F for company formation.

For both business types, it is mandatory to obtain a Taxpayer Identification Number (TIN) certificate from the National Board of Revenue (NBR), followed by acquiring a trade license. Entrepreneurs must also secure rental or purchase agreements for industry space and follow regulatory guidelines if the industry falls under specific zones like BEZA, BEPZA, BHTPA, or BSCIC. Additionally, the business must obtain necessary clearances and approvals, such as a fire license from FSCD, environmental clearance from the Department of Environment (DOE), and a layout plan approval from DIFE. Other essential steps include obtaining membership in a trade body, acquiring a No Objection Certificate (NOC) for controlled industries, and adhering to RAJUK/CDA/KDA/RDA procedures for construction approvals.

To facilitate import operations, businesses need a recommendation from BIDA and an Import Registration Certificate (IRC) from the Chief Controller of Imports and Exports (CC&I). Furthermore, industrial VAT registration should be obtained with the recommendation of BIDA and IRC approval from CC&I. Once these steps are completed, the business can officially commence operations.

Foreign Investment Registration:

Foreign investors in Bangladesh must register through an Investment Promotion Agency (IPA) based on their investment sector. IPAs play a key role in supporting the government’s economic goals by operating in the business domain. In Bangladesh, IPAs not only facilitate and promote investment but also serve as regulators. They are responsible for registering investment projects, which is necessary to access incentives like tax exemptions, import duty exemptions, and more. IPAs also provide permissions for establishing commercial offices and issue work permits for foreign employees, with a focus on knowledge and technology transfer. Additional services offered include visa recommendations, IRC (Import Registration Certificate) recommendations, approval for remittances and foreign borrowing, investment aftercare, counseling, and more. Below are the registration procedures for the major IPAs in Bangladesh:

Bangladesh Investment Development Authority (BIDA)

BIDA is the apex investment promotion agency of Bangladesh. It is the first destination for investors exploring opportunities in Bangladesh. BIDA was established under the BIDA Act of 2016, is tasked with accelerating the country’s industrial development by offering a wide range of promotional and facilitating services. Its core functions are broadly categorized into investment promotion, investment facilitation, and policy advocacy. BIDA provides pre-investment counseling to guide potential investors, facilitates the registration and approval of private industrial projects, and grants permissions for branch, liaison, and representative offices. The agency also handles visa recommendations and work permits for foreign nationals, and approves royalty remittances, technical know-how agreements, and technical assistance fees. Additionally, BIDA supports the import of capital machinery and raw materials, oversees the approval of foreign loans and supplier credits, and offers aftercare services to ensure the continued success of investments in Bangladesh.

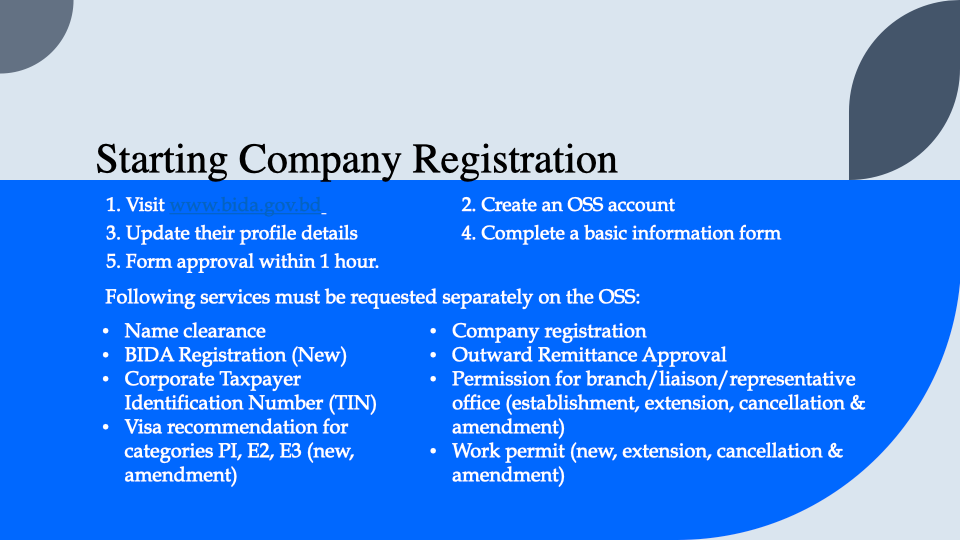

Starting Company Registration

To start the company registration process, the investor has to go to www.bida.gov.bd, create an OSS account, update their profile details, and complete a basic information form. The form will be approved within an hour, allowing the investor to begin using the OSS. Each of the following services must be requested separately on the OSS:

- Name clearance

- Company registration

- BIDA Registration (New)

- Outward Remittance Approval

- Corporate Taxpayer Identification Number (TIN)

- Permission for branch/liaison/representative office (establishment, extension, cancellation & amendment)

- Visa recommendation for categories PI, E2, E3 (new, amendment)

- Work permit (new, extension, cancellation & amendment)

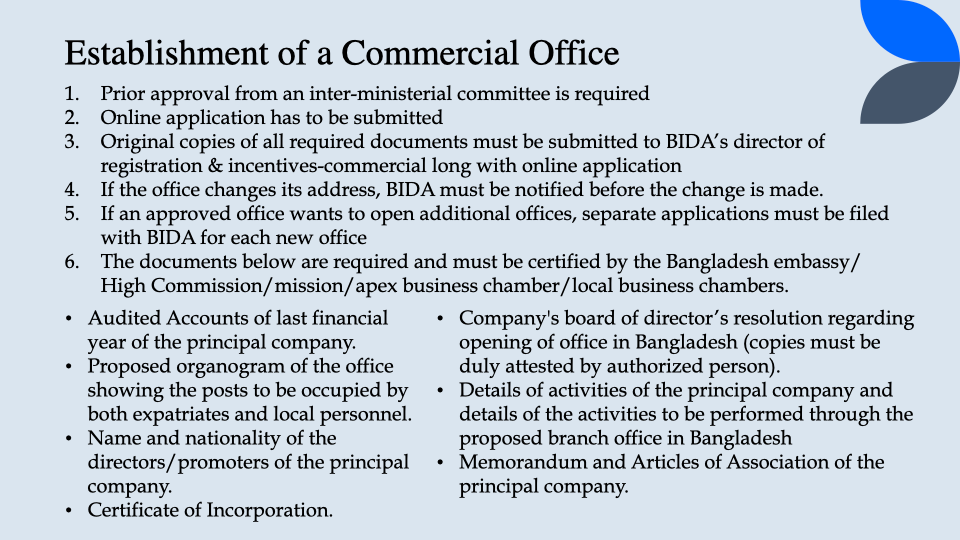

Establishment of a Commercial Office

In order to establish a commercial office for a new branch/liaison/representative office, prior approval by an inter-ministerial committee is a must. Along with an online application, an applicant must submit the original copies of all documents to BIDA’s Director of Registration & Incentives-Commercial. If the office changes address, BIDA must be notified before the change is carried out. If an approved branch/liaison office wants to set up more offices, separate applications will have to be filed with BIDA. The documents below must be certified by the Bangladesh Embassy/High Commission/mission/ apex business chamber/local business chambers.

- Audited Accounts of last financial year of the principal company.

- Company’s board of director’s resolution regarding opening of office in Bangladesh (copies must be duly attested by authorized person).

- Proposed organogram of the office showing the posts to be occupied by both expatriates and local personnel.

- Details of activities of the principal company and details of the activities to be performed through the proposed branch office in Bangladesh.

- Name and nationality of the directors/promoters of the principal company.

- Memorandum and Articles of Association of the principal company.

- Certificate of Incorporation.

Post-incorporation Compliance

After incorporation of foreign investment, there are certain post-incorporation compliances that is required for a private industrial project to be carried out. Among them registration with BIDA is a mandate in order to get the facilities and the institutional support offered by the government. However, projects to be registered with BIDA must be located outside the jurisdiction of BEZA, BEPZA, BHTPA, BSCIC, as these investment promotion agencies provide their own set of incentives and privileges to investors. BIDA registration is not a requirement for commercial and trading activities, buying houses and service-oriented institutions. Investment projects are registered in all offices of BIDA, regardless of project status. Three types of investment require registration:

- Local investment

- Foreign investment

- Joint-venture between foreign and local investors

Privileges and Facilities

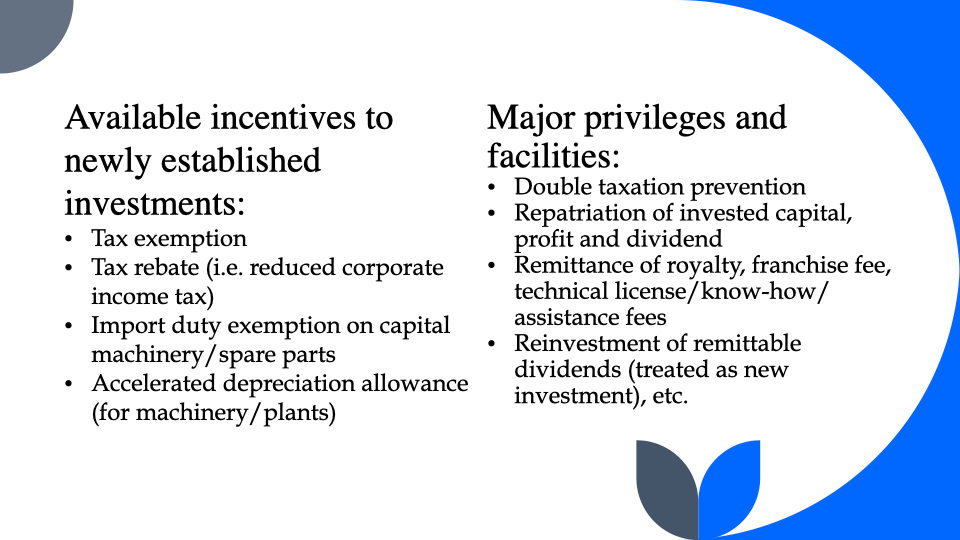

Registration with BIDA comes with numerous service and facilities as per the investment and project status. The following general investment incentives are made available to newly established investments and not applicable in case of re-investments or extensions:

- Tax exemption

- Tax rebate (i.e. reduced corporate income tax)

- Import duty exemption on capital machinery/spare parts

- Accelerated depreciation allowance (for machinery/plants)

The following licenses and permits can only be availed following registration with BIDA:

- VISA recommendation

- Expatriate work permit

- Remittance approval of royalty and technical assistance-related fees

- Foreign borrowing approval

- Recommendation for Import Registration Certificate (IRC) for importing capital machinery

- and materials for industrial use

- Customs clearance certificate for imported machinery and equipment

- Utility connections etc.

The following are among the major privileges and facilities provided to BIDA-registered investors:

- Double taxation prevention

- Repatriation of invested capital, profit and dividend

- Remittance of royalty, franchise fee, technical license/know-how/assistance fees

- Reinvestment of remittable dividends (treated as new investment), etc.

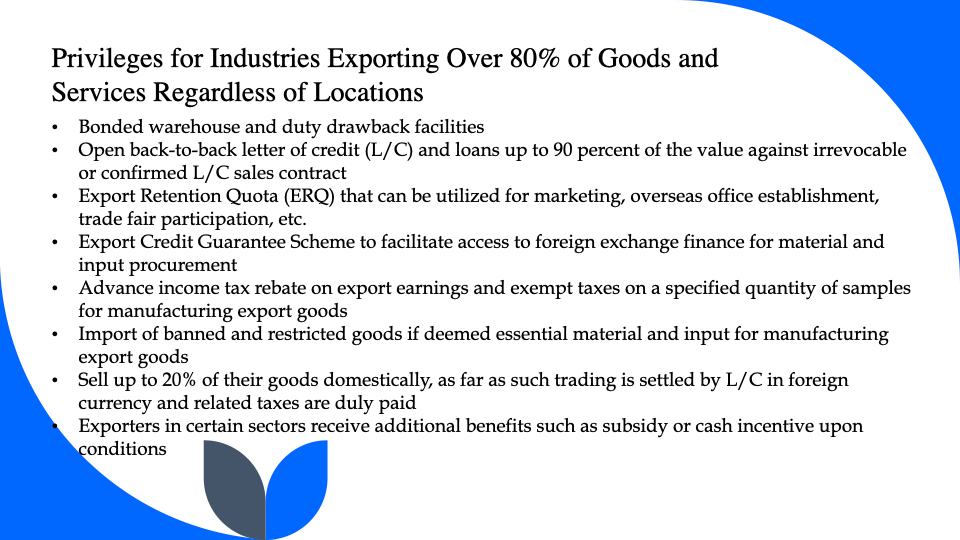

Industries that export more than 80 percent of their goods and services can benefit from the following privileges and facilities, regardless of their locations, which can be within or outside an Economic Zone or Export Processing Zone.

- Bonded warehouse and duty drawback facilities

- Open back-to-back letter of credit (L/C) and loans up to 90 percent of the value against irrevocable or confirmed L/C sales contract

- Export Retention Quota (ERQ) that can be utilized for marketing, overseas office establishment, trade fair participation, etc.

- Export Credit Guarantee Scheme to facilitate access to foreign exchange finance for material and input procurement

- Advance income tax rebate on export earnings and exempt taxes on a specified quantity of samples for manufacturing export goods

- Import of banned and restricted goods if deemed essential material and input for manufacturing export goods

- Sell up to 20% of their goods domestically, as far as such trading is settled by L/C in foreign currency and related taxes are duly paid

- Exporters in certain sectors receive additional benefits such as subsidy or cash incentive upon conditions

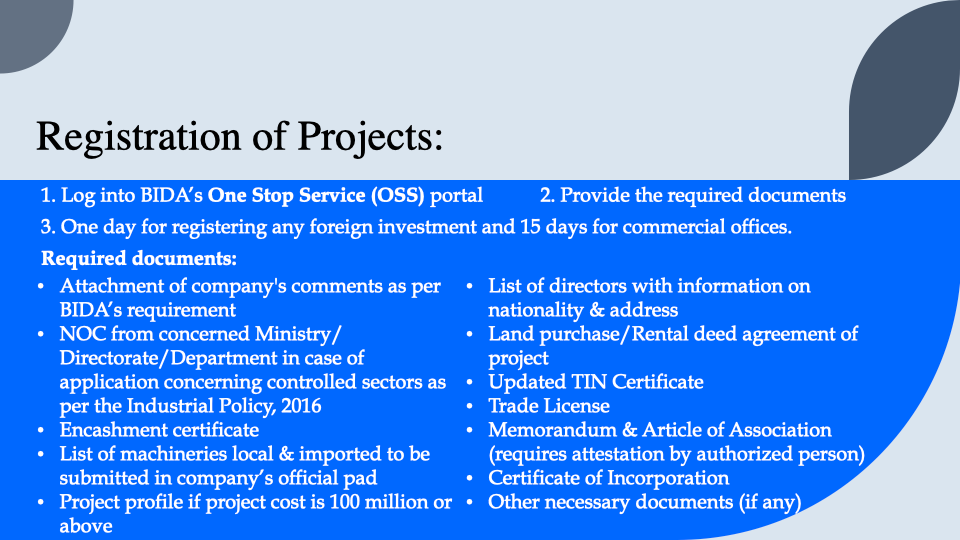

Registration of Projects

Investors can register their projects by simply logging into BIDA’s One Stop Service (OSS) portal. Once all required documents are provided, it takes one day to register a foreign investment project. However, it takes 15 days to register. Below are the lists of required documents:

- Attachment of company’s comments as per BIDA’s requirement

- NOC from concerned Ministry/ Directorate/Department in case of application concerning controlled sectors as per the Industrial Policy, 2016

- Encashment certificate

- List of machineries local & imported to be submitted in company’s official pad

- Project profile if project cost is 100 million or above

- List of directors with information on nationality & address

- Land purchase/Rental deed agreement of project

- Updated TIN Certificate

- Trade License

- Memorandum & Article of Association (requires attestation by authorized person)

- Certificate of Incorporation

- Other necessary documents (if any)

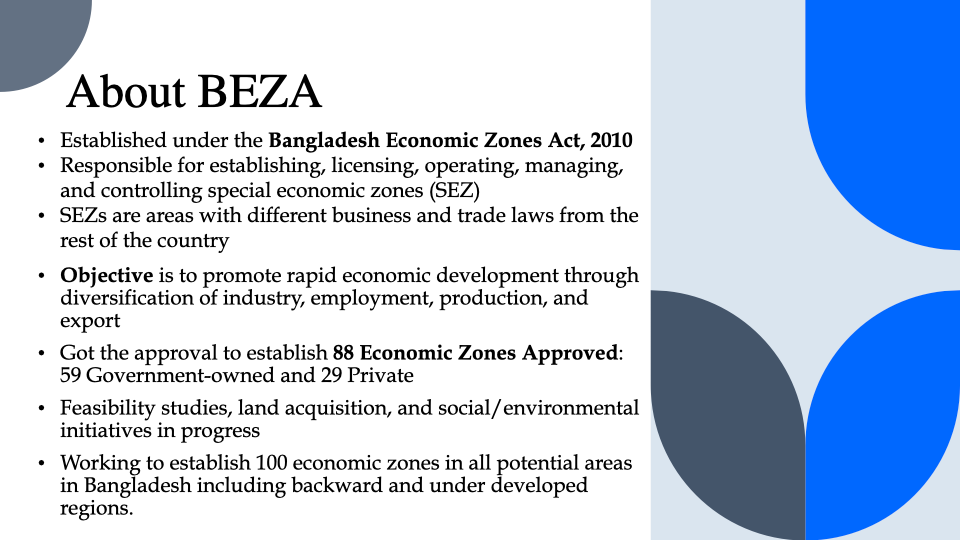

Bangladesh Economic Zones Authority (BEZA)

BEZA’s mandate to establish, license, operate, manage and control economic zones is provided by the Bangladesh Economic Zones Act, 2010. A special economic zone is an area in which the business and trade laws are different from the rest of the country. Instituted in 2010, BEZA is working to establish 100 economic zones in all potential areas in Bangladesh including backward and under developed regions. The goal is to encourage rapid economic development through diversification of industry, employment, production and export. Until now, BEZA has got the approval to establish 88 economic zones countrywide comprising 59 Government and 29 Private EZs, for which feasibility studies, land acquisition and identifying area specific social and environmental initiatives are underway. BEZA has also been working to establish government to government EZs, public private partnership EZs and special tourism parks.

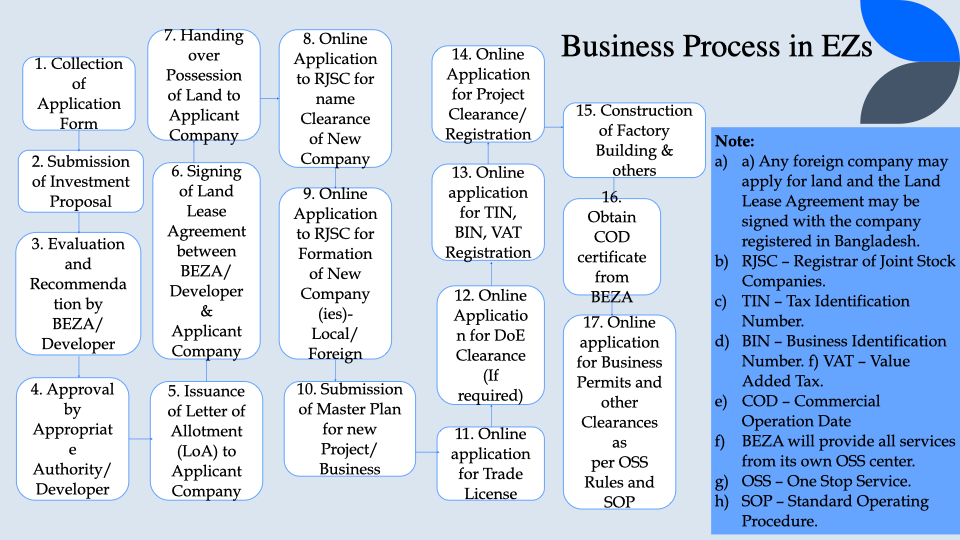

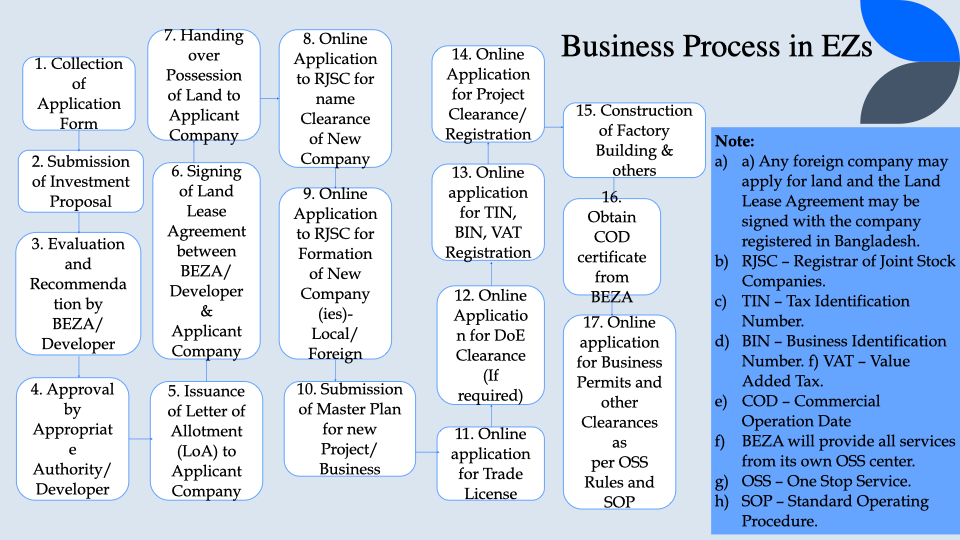

Business Process

The document outlines the business process for setting up operations in the economic zones managed by the Bangladesh Economic Zones Authority (BEZA). The process begins with the collection of an application form, followed by the submission of an investment proposal. BEZA or the designated developer evaluates the proposal and provides recommendations. Once approved by the appropriate authority or developer, a Letter of Allotment (LoA) is issued to the applicant company, confirming the allocation of land or resources. A land lease agreement is then signed between BEZA (or the developer) and the applicant company, after which possession of the land is handed over.

The next steps involve registering the business. The applicant must apply online to the Registrar of Joint Stock Companies (RJSC) for name clearance and then proceed with the formation of a new company, whether local or foreign. A master plan for the project must also be submitted to BEZA, followed by obtaining a trade license through an online application. For industries requiring environmental clearance, an online application must be submitted to the Department of Environment (DoE).

Tax and business registrations are also required, including applications for a Tax Identification Number (TIN), Business Identification Number (BIN), and Value Added Tax (VAT) registration. Additionally, project clearance or registration must be completed online. Once all approvals are secured, construction of the factory building and other facilities can commence. The company must then obtain a Commercial Operation Date (COD) certificate from BEZA, signifying readiness for operation. Finally, the applicant must apply online for any remaining permits and clearances as per BEZA’s One-Stop Service (OSS) rules and Standard Operating Procedures (SOP).

Foreign companies may apply for land but must register a company in Bangladesh to sign the land lease agreement. Investment types are categorized as 100% foreign-owned (Type A), joint ventures (Type B), or 100% locally-owned (Type C). BEZA’s OSS provides streamlined services to facilitate these processes, ensuring efficient business setup within the economic zones.

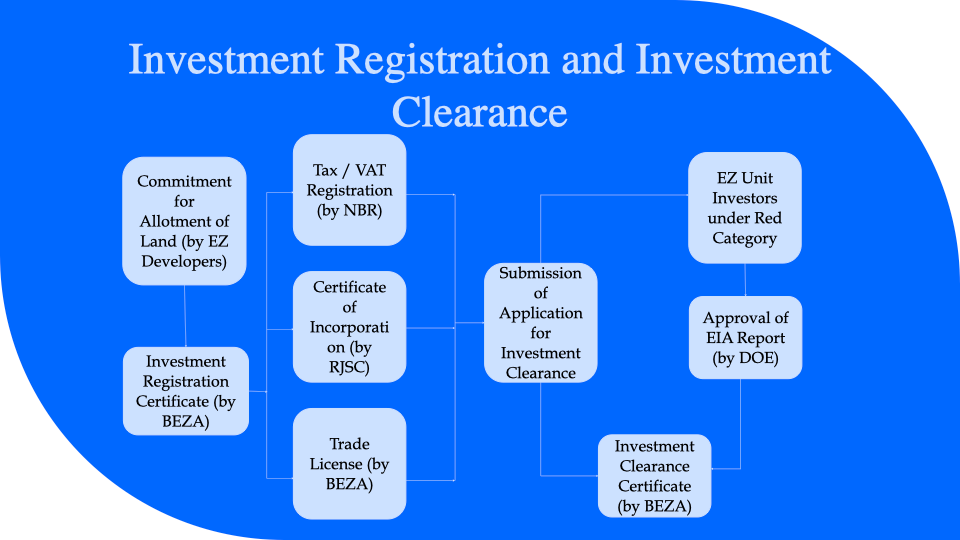

Standard Operating Procedure for Investment Registration and Investment Clearance

In order to establish any industries in the EZs, first of all, the EZ Unit Investors shall apply for Commitment for Allotment of Land to the EZ Developer where they would like to invest.

In case of EZ developed and promoted by BEZA, the EZ Unit Investor shall apply for plots to BEZA. After obtaining a letter of Commitment for Allotment of Land that issued either by BEZA or by any EZ Developers, all the EZ Unit Investors shall complete Investment Registration through BEZA OSSC. For Investment Registration, EZ Unit investors have to fill-in below fields (mandatory fields) of the online application form (FORM-IC01):

- 1. Authorized Applicant’s Information

- 4 (a). Investment Plan

- 7. Area of Land/SFB to be allotted

- 9. Proposed Production Plan

- 11. Manpower Requirement

EZ Unit investors may fill-in other fields as well. But, EZ Unit investors have to fill-in above stated fields (mandatory fields) for the application of Investment Registration.

After receiving Investment Registration Certificate issued by BEZA with the Registration Number and Date, the EZ Unit Investors may go to next steps such as Certificate of Incorporation issued by RJSC, Trade License issued by BEZA and Income Tax/VAT Registration Certificates issued by NBR accordingly.

Then, they may apply for Investment Clearance through BEZA OSSC. For Investment Clearance Certificate, EZ Unit investors have to fill-in all the fields of the online application form (FORM-IC-01). If the submitted documents are in right order, BEZA starts the assessment of the proposed investment proposal. After confirming its conformity of the proposed investment proposal BEZA issues the Investment Clearance Certificate and provide it to the EZ Unit Investor through BEZA OSSC.

Meanwhile, if the proposed investment proposal is falling under “Red Category” industry as defined in the Environmental Conservations Rules 1997, the Investment Clearance Certificate is issued after the EZ Unit Investor receives the Approval of EIA Report issued by DOE.

It may be mentioned here that the formal land lease agreement for allotment of land shall be executed by the EZ Developer and the EZ Unit Investor before the issuance of Investment Clearance Certificate by BEZA.

Issuance of Investment Registration Certificate

BEZA provides Investment Registration Certificate to the investors as per Section 19 (5) of BEZA Act 2010. Documents that are required for this are:

- Application Form (FORM-IC-01) signed by the Legal Representative of the Applicant Company

- Copy of Commitment for Allotment of LAND issued by EZ Developer

- Conceptual Master Plan indicating the specific plots allotted to the applicant company

- Copies of License/Approval Certificates (if obtained)

Investment Registration Certificate can be issued by following an online process. The procedure for issuance of Investment Registration Certificate is as follows:

- The applicant visits BEZA OSSC portal and creates an account

- The applicant fills-in the Application Form [applicant must fill up field no. 1, 4 (a), 7, 9 & 11 of the application form (FORM-IC01)] through online and uploads required documents

- The BEZA official reviews and checks the Application Form and other documents submitted by the applicant

- If the submitted documents are confirmed its conformity, the BEZA issues “Investment Registration Certificate”.

- The applicant receives Investment Registration Certificate electronically and BEZA OSSC also hands over a hard copy.

The time frame required for this issuance is 7 (seven) working days after officially receiving the application. The fee of the Investment Registration and Clearance should be paid once which is USD 500 equivalent BDT + 15% VAT. If the investors once pay for the Investment Registration, then investors do not need to pay for the Investment Clearance again.

Issuance of Investment Clearance Certificate:

BEZA provides Investment Clearance Certificate to the investors as per Section 19 (5) of BEZA Act 2010. Documents that are required for this are:

- Application Form (FORM-IC-02) signed by the Legal Representative of the Applicant Company

- Land lease agreement document

- Plot Number, Mouza & Daag Number (if applicable)

- Outline of Proposed Investment

- Details of Signatory- Particulars of the Directors, Manager and Managing Agents and of any Therein (Form-12)

- Conceptual Master Plan indicating the specific plots allotted to the applicant company

- Design & Schedule of Construction

- Shareholders’ Investment Agreement duly notarized

- Audited Financial Statements of the sponsor company for the last 3 years (if applicable)

- Bank Solvency Certificate issued by the applicant’s bank

- Tax Return of the sponsor company for the last 3 years

- Certificate of Incorporation along with Memorandum & Articles of Association of the company duly notarized (English version)

- Trade License

- Summary of Project Details (Notarized)

- VAT Registration

Investment Clearance Certificate can be issued by following an online process. The procedure for issuance of Investment Registration Certificate is as follows:

- The applicant visits BEZA OSSC portal and creates an account

- The applicant fills-in the Application Form through online and uploads required supporting documents

- The BEZA official reviews and checks the Application Form and other documents submitted by the applicant

- If the submitted documents are confirmed its conformity, the BEZA issues “Investment Clearance Certificate”.

- The applicant receives Investment Clearance Certificate electronically and BEZA OSSC also hands over a hard copy.

The time frame required for this issuance is 20 (twenty) working days after officially receiving the application. The fee of the Investment Clearance should be paid once which is USD 500 equivalent BDT + 15% VAT. If the investors once pay for the Investment Registration, then investors do not need to pay for the Investment Clearance again.

Issuance of Investment Clearance Certificate (for Red Category Industries):

BEZA provides Investment Clearance Certificate (for Red Category Industries) to the investors as per Section 19 (5) of BEZA Act 2010. Documents that are required for this are:

- Application Form (FORM-IC-02) signed by the Legal Representative of the Applicant Company

- Land lease agreement document

- Plot Number, Mouza & Daag Number (if applicable)

- Outline of Proposed Investment

- Details of Signatory- Particulars of the Directors, Manager and Managing Agents and of any Therein (Form-12)

- Conceptual Master Plan indicating the specific plots allotted to the applicant company

- Design & Schedule of Construction

- Shareholders’ Investment Agreement duly notarized

- Audited Financial Statements of the sponsor company for the last 3 years (if applicable)

- Bank Solvency Certificate issued by the applicant’s bank

- Tax Return of the sponsor company for the last 3 years

- Certificate of Incorporation along with Memorandum & Articles of Association of the company duly notarized (English version)

- Trade License

- Summary of Project Details (Notarized)

- VAT Registration

After receiving Approval of EIA

- Copy of DOE letter mentioning the approval of the EIA report

Investment Clearance Certificate (for Red Category Industries) can be issued by following an online process. The procedure for issuance of Investment Registration Certificate is as follows:

- The applicant visits BEZA OSSC portal and creates an account

- The applicant fills-in the Application Form through online and uploads required supporting documents

- The BEZA official reviews and checks the Application Form and other documents submitted by the applicant

- The applicant submits the EIA approval letter approved by DOE along with required documents through online BEZA OSSC

- The BEZA official reviews and checks the EIA Report and other documents submitted by the applicant

- If the submitted documents are confirmed its conformity, the BEZA issues “Investment Clearance Certificate (ICC)”

- The applicant receives Investment Clearance Certificate electronically and BEZA OSSC also hands over a hard copy.

The time frame required for this issuance is 20 (twenty) working days after officially receiving the application. The fee of the Investment Clearance should be paid once which is USD 500 equivalent BDT + 15% VAT. If the investors once pay for the Investment Registration, then investors do not need to pay for the Investment Clearance again.

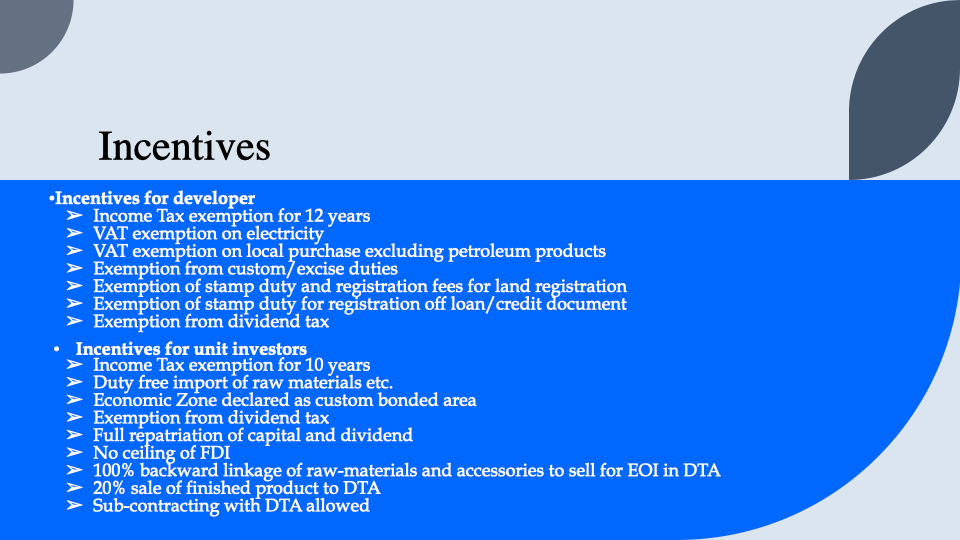

Incentives

BEZA provides many incentives both to manufacturing unit investors and the developers of the Economic Zones.

Incentives for developer:

- Income Tax exemption for 12 years

- VAT exemption on electricity

- VAT exemption on local purchase excluding petroleum products

- Exemption from custom/excise duties

- Exemption of stamp duty and registration fees for land registration

- Exemption of stamp duty for registration off loan/credit document

- Exemption from dividend tax

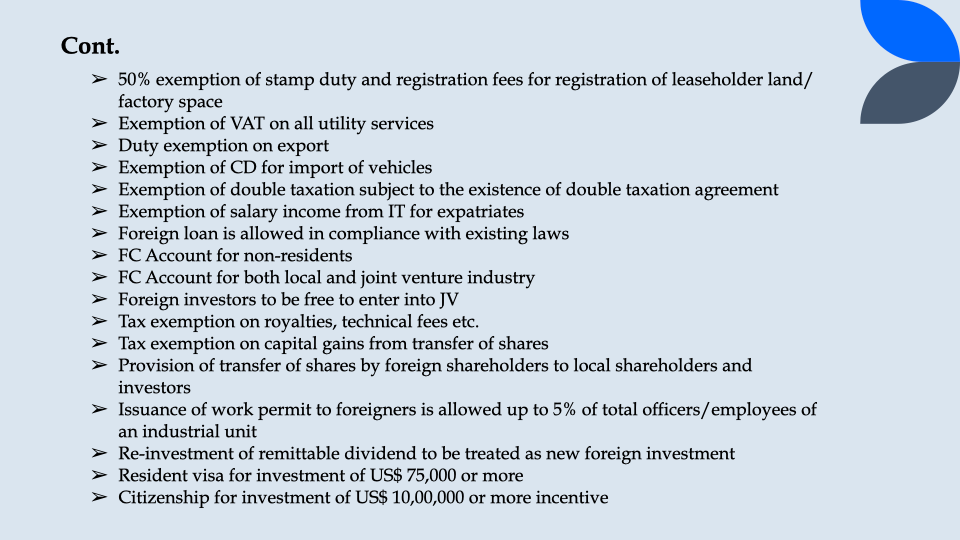

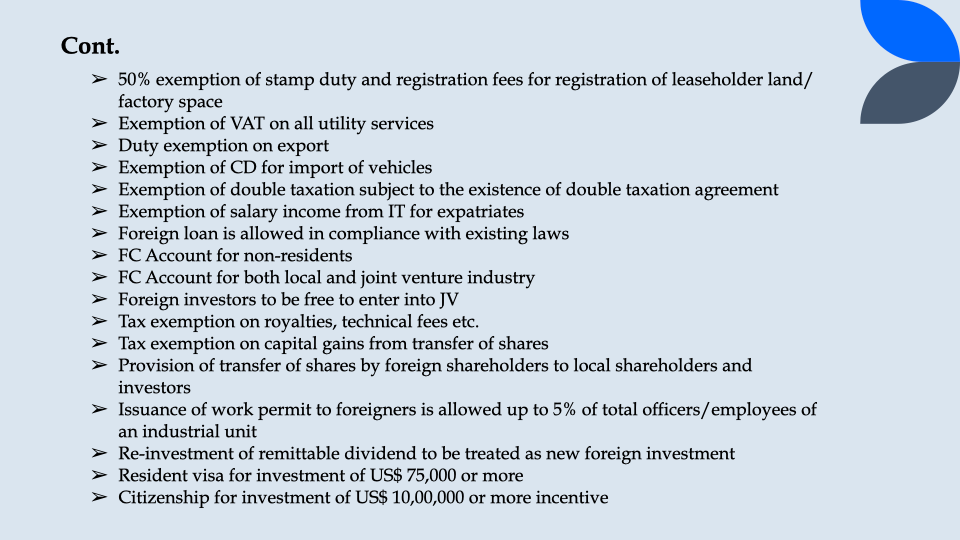

Incentives for unit investors:

- Income Tax exemption for 10 years

- Duty free import of raw materials etc.

- Economic Zone declared as custom bonded area

- Exemption from dividend tax

- Full repatriation of capital and dividend

- No ceiling of FDI

- 100% backward linkage of raw-materials and accessories to sell for EOI in DTA

- 20% sale of finished product to DTA

- Sub-contracting with DTA allowed

- 50% exemption of stamp duty and registration fees for registration of leaseholder land/factory space

- Exemption of VAT on all utility services

- Duty exemption on export

- Exemption of CD for import of vehicles

- Exemption of double taxation subject to the existence of double taxation agreement

- Exemption of salary income from IT for expatriates

- Foreign loan is allowed in compliance with existing laws

- FC Account for non-residents

- FC Account for both local and joint venture industry

- Foreign investors to be free to enter into JV

- Tax exemption on royalties, technical fees etc.

- Tax exemption on capital gains from transfer of shares

- Provision of transfer of shares by foreign shareholders to local shareholders and investors

- Issuance of work permit to foreigners is allowed up to 5% of total officers/employees of an industrial unit

- Re-investment of remittable dividend to be treated as new foreign investment

- Resident visa for investment of US$ 75,000 or more

- Citizenship for investment of US$ 10,00,000 or more incentive

Bangladesh Export Processing Zones Authority (BEPZA)

BEPZA is the official organ of the government for promotion, attraction and facilitation of foreign investment in the EPZs. BEPZA also supervises compliance with social, environmental and workplace standards with the aim of ensuring harmonious labor and industrial relations in EPZs. The activities of BEPZA are guided by the Bangladesh Export Processing Zones Authority Act, 1980. Export processing zones (EPZ) are territorial or economic enclave in which goods may be imported and manufactured and reshipped with a reduction in duties/and/or minimal intervention by customs officials. There are 8 EPZs across Bangladesh:

- Chattogram EPZ

- Dhaka EPZ

- Mongla EPZ

- Ishwardi EPZ

- Cumilla EPZ

- Uttara EPZ

- Adamjee EPZ

- Karnaphuli EPZ

Three types of investment are registered under BEPZA:

- 100% foreign ownership

- Joint venture

- 100% local venture

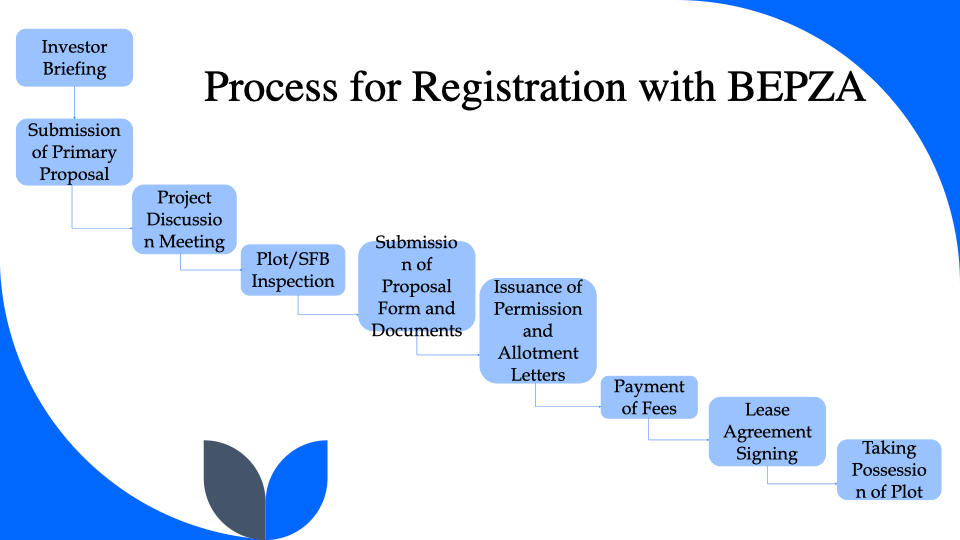

Process for Registration with BEPZA

The registration process with BEPZA (Bangladesh Export Processing Zones Authority) for setting up an industry in an Export Processing Zone (EPZ) involves several key steps:

- Investor Briefing: The process begins with a briefing where investors are informed about the investment opportunities and the benefits of setting up a business within an EPZ. This helps investors understand the framework, rules, and potential advantages.

- Submission of Primary Proposal: Investors are then required to submit a primary proposal for their investment. This proposal includes a brief overview of the planned project, providing initial details for evaluation.

- Project Discussion Meeting: Following the submission, the investor attends a meeting with the General Manager (GM) of Investment Promotion (IP), or a member of BEPZA’s executive team. In this meeting, the investor presents their project, and a more detailed discussion takes place, offering further clarification and aligning expectations.

- Plot/SFB Inspection: If the investor is interested in a specific plot of land or a Standard Factory Building (SFB), the GM of the respective zone will show the available options. This step provides the investor with an opportunity to inspect the location that could be allotted for their project.

- Submission of Proposal Form and Documents: Once the investor has made their selection, they must purchase the project proposal form and submit it, along with all the required supporting documents. This submission initiates the official application process.

- Issuance of Permission and Allotment Letters: After reviewing the submitted documents and conducting a necessary scrutiny process according to BEPZA’s guidelines, BEPZA will issue a permission letter to the investor. This letter grants approval to set up an industry within the EPZ. Additionally, an allotment letter for the selected plot or SFB will be provided.

- Payment of Fees: Upon receiving the permission and allotment letters, the investor is required to make the necessary payments. This includes a security deposit, stamp duty (in case land is allotted), and the BEPZA registration fee. These payments must be made to proceed with the next steps.

- Lease Agreement Signing: A lease agreement is then signed between the investor’s company and BEPZA for the allocated plot or SFB. This formalizes the relationship and establishes the terms and conditions for using the land or building for the industrial setup.

- Taking Possession of Plot: Finally, the investor takes possession of the plot or SFB from the concerned zone. This marks the completion of the registration process, and the investor can now begin setting up their industrial operations within the EPZ.

This process ensures that all necessary legal, financial, and regulatory requirements are met before an industry can be established in an EPZ, providing a structured and transparent path for investors.

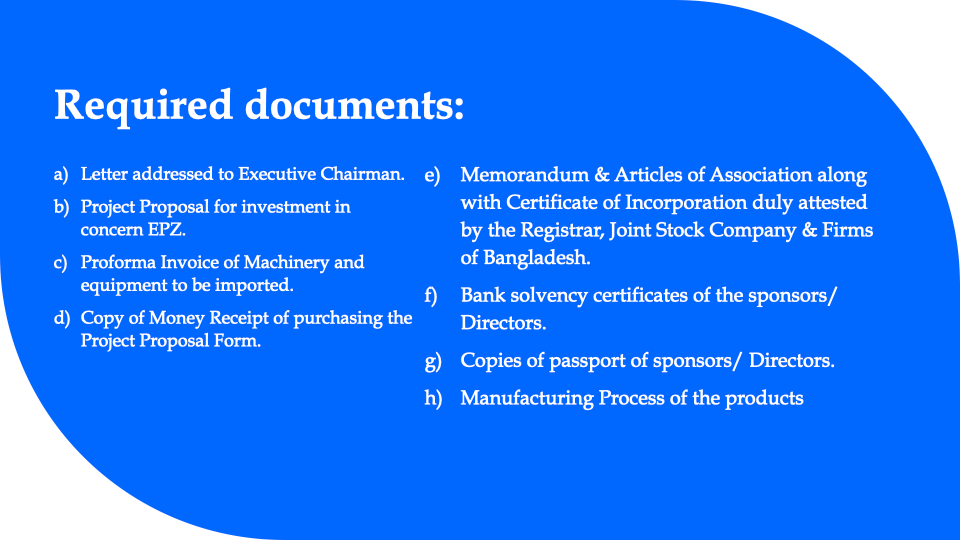

Required documents for permission to set up industry in EPZs:

- Letter addressed to Executive Chairman.

- Project Proposal for investment in concern EPZ.

- Proforma Invoice of Machinery and equipment to be imported.

- Copy of Money Receipt of purchasing the Project Proposal Form.

- Memorandum & Articles of Association along with Certificate of Incorporation duly attested by the Registrar, Joint Stock Company & Firms of Bangladesh.

- Bank solvency certificates of the sponsors/Directors.

- Copies of passport of sponsors/ Directors.

- Manufacturing Process of the products.

Required documents for permission to set up industry in EPZs

- Letter addressed to Executive Chairman.

- Project Proposal for investment in concern EPZ.

- Proforma Invoice of Machinery and equipment to be imported.

- Copy of Money Receipt of purchasing the Project Proposal Form.

- Memorandum & Articles of Association along with Certificate of Incorporation duly attested by the Registrar, Joint Stock Company & Firms of Bangladesh.

- Bank solvency certificates of the sponsors/Directors.

- Copies of passport of sponsors/ Directors.

- Manufacturing Process of the products.

Incentives

BEPZA provides the following incentives

- Plots/factory buildings in customs bonded area

- Infrastructural facilities

- Administrative facilities

- Fiscal & non-fiscal incentives

- EPZ attracts: foreign & local investment

BEPZA offers many fiscal and non-fiscal incentives for the investors in the EPZs. Some of the incentives are:

The fiscal incentives:

- Tax Holiday of 5-7 years

- Duty free import of machinery, equipment & construction materials.

- Duty free import of raw materials.

- Duty free export of finished goods.

- Relief from double taxation.

- Exemption from dividend tax for tax holiday period.

- Taking and offering subcontracting are allowed both inside and outside EPZ.

- Sale of 10% finished products except garments to Domestic Tariff Area (DTA) is allowed.

- Sale of 10% defective finished goods to DTA is allowed subject to approval of a committee.

- Sale of 10% surplus raw materials to DTA is allowed.

The non-fiscal incentives:

- No ceiling on foreign and local Investment.

- 100% foreign ownership permissible.

- Full repatriation of profit, capital & establishment.

- Foreign currency loan from abroad under Off-Shore Banking Unit (OBU) facilities.

- Non-resident Foreign Currency Deposit (NFCD) allowed for ‘A’ type industries.

- Operation of FC account by ‘B’ and ‘C’ type Industries allowed.

Services

Permission for Industry Setup

BEPZA provides permission for setting up industries in Export Processing Zones (EPZs) with minimal required documentation, simplifying the initial steps for investors.

Allotment of Industrial Plots/Factory Buildings

Investors can obtain fully serviced industrial plots or Standard Factory Buildings (SFBs) for setting up their industries within EPZs, ensuring optimal infrastructure for business growth.

Duty-Free Import and Export

BEPZA facilitates the duty-free import of raw materials, machinery, and construction materials, as well as the duty-free export of finished goods, enhancing cost-effectiveness for industries.

Expedited Import & Export Services

Expedited services for obtaining Import & Export Permits are available through automation, ensuring processing within the same day to support swift business operations.

One Stop Service (OSS)

The OSS center offers a comprehensive one-stop service, handling all necessary approvals and documentation for investors, making business operations hassle-free.

Work Permit for Foreign Expatriates

BEPZA handles the issuance of work permits for foreign expatriates, simplifying the hiring process for industries in EPZs.

Water and Electricity Connections

BEPZA ensures a seamless connection of water and electricity services, providing essential utilities to industries located within EPZs.

24/7 Security Service

Industries benefit from round-the-clock security services, ensuring a safe and secure environment for both workers and assets.

Customs Clearance at Factory Site

Customs clearance is efficiently managed directly at the factory site, reducing the time and complexity associated with logistics.

Flexible Import and Export Terms

BEPZA allows imports and exports on CM (Cut-Make), CMP (Cut-Make-Pack), and CMT (Cut-Make-Trim) basis, providing flexibility in business operations.

Import from Domestic Tariff Area (DTA)

Industries in EPZs are permitted to import goods from the Domestic Tariff Area (DTA), further supporting their operational needs.

Sub-Contracting and Transfer of Goods

Intra- and inter-zone sub-contracting, as well as the transfer of goods, are allowed, offering businesses flexibility in their production processes.

Sub-Contracting with Export Oriented Industries

Sub-contracting with export-oriented industries inside and outside the EPZ is permitted, fostering collaboration and growth.

No Requirement for IRC or ERC

There is no need for an Import Registration Certificate (IRC) or an Export Registration Certificate (ERC), reducing the regulatory burden on businesses.

Administrative Support Services

BEPZA offers various administrative support services such as commissariat, medical centers, investors’ clubs, and health clubs to cater to the needs of investors and their staff.

Banking and Transfer of Capital

Non-residents have two options for holding and operating bank accounts in Bangladesh: Foreign Currency Accounts (FCA) and Non-Resident Foreign Currency Deposit (NFCD) accounts, or Taka accounts. The FCA and NFCD accounts allow non-residents to deposit foreign currency brought from abroad, with balances being freely transferable. Alternatively, foreign investors can open and manage Taka accounts while residing in Bangladesh. Non-residents can also open a Non-resident Investor’s Taka Account (NITA) specifically for portfolio investments in the country, funded through foreign currency transferred via banking channels.

Regarding the movement of currency, there are no restrictions on bringing foreign currency into Bangladesh, though customs declarations are required for amounts exceeding USD 5,000. Additionally, currency brought into the country can be freely taken out.

When it comes to capital transfer and repatriation, the rules differ for listed and non-listed companies. For listed companies, the proceeds from selling shares, including capital gains, can be repatriated without prior approval through a NITA account. However, for non-listed companies, repatriation requires prior approval from Bangladesh Bank, unless specific valuation and reporting guidelines are adhered to. Share transfers between non-residents do not require approval, but sales proceeds from such transfers must follow required valuation methods and documentation for repatriation.

The valuation and approval requirements for non-listed companies vary based on the amount involved. For amounts up to BDT 10 million, no valuation report or prior approval is necessary. For amounts between BDT 10 million and BDT 100 million, a valuation report is required, with post-facto reporting to Bangladesh Bank. For transactions exceeding BDT 100 million, prior approval from Bangladesh Bank is mandatory.

Payments for royalties and technical fees are permitted, but they are capped at 6% of the previous year’s sales or 6% of the imported machinery costs for new projects. Any agreements related to royalties or technical fees must be registered with the Bangladesh Investment Development Authority (BIDA), and any deviations from these limits require prior approval.

For remitting profits and dividends, branches of foreign companies can transfer post-tax profits without restrictions. However, non-banking branches require approval from BIDA and Bangladesh Bank. Dividends can be remitted to non-resident shareholders through banks and can also be credited to their foreign currency accounts for reinvestment or further remittance.

Foreign employees working in Bangladesh are allowed to remit up to 75% of their monthly salary, along with eligible retirement benefits. Salaries for leave periods can also be remitted, provided they comply with the terms specified in approved contracts.

Winding Up, Repatriation, and Borrowing Procedures for Foreign-Related Companies in Bangladesh

When a business in Bangladesh is winding up, specific procedures must be followed to repatriate any residual money payable to foreign shareholders. If the liquidation is directed by a court or under its supervision, the authorized dealer (bank) must submit an application to the Foreign Exchange Investment Department (FEID) of the Bangladesh Bank. This application should include a court order, a certificate from the liquidator or official receiver, or another authorized individual, along with documentation confirming that all liabilities within Bangladesh have been settled. For voluntary winding-up, the authorized dealer must also apply to FEID with all necessary documents to remit funds owed to foreign shareholders. Detailed procedures are provided in FEID Circular No. 1, dated February 5, 2020, available on the Bangladesh Bank website.

For borrowing, foreign-controlled or foreign-owned companies operating in Bangladesh can obtain local currency loans from banks based on standard credit practices. Such loans are subject to conditions: the loan amount must not exceed the equity held by Bangladeshi nationals, and the company’s total debt must not surpass its equity. Joint venture industries in Export Processing Zones (EPZs) may also receive local currency loans up to the value of any short-term foreign currency loans they have secured.

For foreign borrowing, prior approval from the Bangladesh Investment Development Authority (BIDA) and the Bangladesh Bank is required. Applications must be submitted in the prescribed format and are reviewed by a committee led by the Governor of the Bangladesh Bank. Repayment of principal and interest on approved foreign loans is processed through authorized dealers. However, fully foreign-owned companies in EPZs can directly borrow from overseas banks or financial institutions without seeking prior approval from BIDA or the Bangladesh Bank.